Page 25 - Cuero, TX Downtown Plan

P. 25

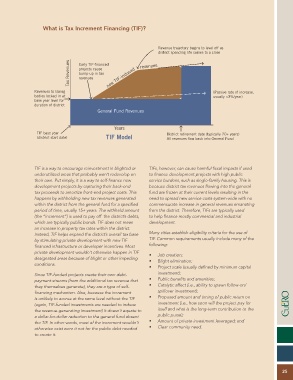

What is Tax Increment Financing (TIF)?

Revenue trajectory begins to level off as

district spending life comes to a close

Tax Revenues Early TIF-financed revenues

new TIF-induced

projects cause

bump-up in tax

revenues

Revenues to taxing (Passive rate of increase,

bodies locked-in at usually <3%/year)

base year level for

duration of district

General Fund Revenues

Years

TIF base year District retirement date (typically 20+ years)

(district start date) TIF Model All revenues flow back into General Fund

TIF is a way to encourage reinvestment in blighted or TIFs, however, can cause harmful fiscal impacts if used

underutilized areas that probably won’t redevelop on to finance development projects with high public

their own. Put simply, it is a way to self-finance new service burdens, such as single-family housing. This is

development projects by capturing their back-end because district tax revenues flowing into the general

tax proceeds to amortize front-end project costs. This fund are frozen at their current levels resulting in the

happens by withholding new tax revenues generated need to spread new service costs system-wide with no

within the district from the general fund for a specified commensurate increase in general revenues emanating

period of time, usually 15+ years. The withheld amount from the district. Therefore, TIFs are typically used

(the “increment”) is used to pay off the district’s debts, to help finance mostly commercial and industrial

which are typically public bonds. TIF does not mean development.

an increase in property tax rates within the district.

Instead, TIF helps expand the district’s overall tax base Many cities establish eligibility criteria for the use of

by stimulating private development with new TIF- TIF. Common requirements usually include many of the

financed infrastructure or developer incentives. Most following:

private development wouldn’t otherwise happen in TIF- • Job creation;

designated areas because of blight or other impeding • Blight elimination;

conditions.

• Project scale (usually defined by minimum capital

Since TIF-funded projects create their own debt- investment);

payment streams (from the additional tax revenue that • Public benefits and amenities;

they themselves generate), they are a type of self- • Catalytic affect (i.e., ability to spawn follow-on/

financing mechanism. Also, because the increment spillover investment);

is unlikely to accrue at the same level without the TIF • Proposed amount and timing of public return on

(again, TIF-funded investments are needed to induce investment (i.e., how soon will the project pay for

the revenue-generating investment) it doesn’t equate to itself and what is the long-term contribution to the

a dollar-for-dollar reduction to the general fund absent public purse);

the TIF. In other words, most of the increment wouldn’t • Amount of private investment leveraged; and

otherwise exist were it not for the public debt needed • Clear community need.

to create it.

ADOPTED 03.04.13 25